The Scam,

The Scammer

and The Scammed

An IT executive lost RM200,000 to bogus bank officials and police personnel in a Macau scam. The amount was lost in a short time last Friday (May 13). Recent news from The Star Malaysia.

A businessman thought he had found a genuine buyer for his limited-edition Rolex Explorer II luxury watch, but ended up falling victim to a well-organised scam syndicate. Another news from New Straits Time Malaysia.

Those two articles were just the introduction before we get into the nitty-gritty of scams.

IT executives and businessmen were duped, but we do wonder how even professional people, educators like teachers and lecturers, lawyers, doctors, etc all educated people, can be scammed.

If you think you aren’t at risk of being scammed, then you’re likely at risk of being a victim. Anyone can be caught in a financial scam, but some people are in greater peril than others. The most vulnerable people are not those most people would expect, especially the potential targets themselves.

A key to remember is that if you believe you aren’t likely to be scammed, then you’re at greater risk than others.

The most likely financial fraud victims are men aged 70 and over. Also, the more of a risk-taker a person is, the more likely he or she is to be scammed. The victims also tend to view money and wealth as signs of success. To them, acquiring wealth is an important achievement in life.

Four Signs That It’s a Scam:

- Scammers pretend to be from an organisation you know. Scammers often pretend to be contacting you on behalf of the government. They might use a real name, like the Social Security Administration, the IRS, or Medicare, or make up a name that sounds official. Some pretend to be from a business you know, like a utility company, a tech company, or even a charity asking for donations. They use technology to change the phone number that appears on your caller ID. So the name and number you see might not be real.

- Scammers say there’s a problem or a Prize. They might say you’re in trouble with the government. Or you owe money. Or someone in your family had an emergency. Or that there’s a virus on your computer. Some scammers say there’s a problem with one of your accounts and that you need to verify some information. Others will lie and say you won money in a lottery or sweepstakes but have to pay a fee to get it.

- Scammers pressure you to act immediately. Scammers want you to act before you have time to think. If you’re on the phone, they might tell you not to hang up so you can’t check out their story. They might threaten to arrest you, sue you, take away your driver’s or business licence, or deport you. They might say your computer is about to be corrupted.

- Scammers tell you to pay in a specific way. They often insist that you pay by sending money through a money transfer company or by putting money on a gift card and then giving them the number on the back. Some will send you a check (that will later turn out to be fake), tell you to deposit it, and then send them money.

Scam Definition

A ‘Scam’ is ‘a trick, a ruse; a swindle, a racket’ (Oxford English Dictionary).

Scam, as it is used currently, is both more specific and more general than its nearest synonym, ‘Fraud’.

Scams have often come to refer to a particular kind of fraudulent or misleading practice, characterised by widely disseminated initial approaches at long distances to people not known to the perpetrator (‘scammer’); the scammer expects a low rate of return on the offer but is able to make a profit because the approach has a low cost.

According to the definition, a mass marketed scam is ‘a misleading or deceptive business practice where you receive an unsolicited or uninvited contact (for example by email, letter, phone, or advertisement) and false promises are made to con you out of money’.

The scam will not work unless the victim makes some kind of response.

Common Scams Examples:

- Bogus lotteries

- Deceptive prize draws and sweepstakes

- Fake psychics

- ‘Miracle’ health cures

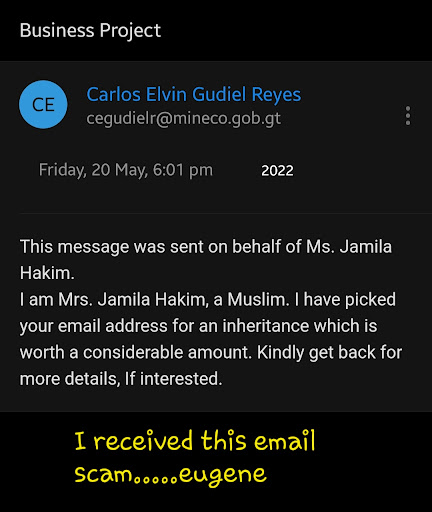

- Foreign money-making (‘advance fee’) offers

- ‘Get-rich-quick’ schemes

A scam becomes fraud when a scammer gets someone’s personal or financial details and uses them for their own gain, or receives money from their target under false pretences. Fraud is a criminal offence. While some scammers will simply ask their target directly for money, others will be more subtle about what they want.

Common Scams Types:

- Romance – when a scammer builds an intense online relationship with someone, then asks for money

- Sextortion – when a victim is persuaded to carry out a sex act on webcam which is then videoed and the scammer demands a ransom in return for not publishing the content on the net

- Pets – a pet is advertised for sale, and then fees are demanded in order to get the pet to its new owner. The pet does not exist.

- Hitman – Someone claims to be a hitman and says that they have been paid to kill you. They then say that if you are prepared to pay more, they will not carry out the threat.

- 419 – named after section 419 of the Nigerian criminal code – claiming money from another person under false pretence: such as needing assistance to release a large sum of fictional inheritance.

Psychological reasons for responding to scams:

- The present research suggests that the psychological reasons for responding to scams involve a mixture of cognitive and motivational processes.

Whilst different kinds of scams do exploit different vulnerabilities to some extent, there are similarities between scams in their content and the use of persuasive techniques.

The greatest and most consistent emphasis was on:

- Appeals to trust and authority

people tend to obey authorities so scammers use, and victims fall for, cues that make the offer look like a legitimate one being made by a reliable official institution or established reputable business

- Visceral triggers

Scams exploit basic human desires and needs – such as greed, fear, avoidance of physical pain, or the desire to be liked – in order to provoke intuitive reactions and reduce the motivation of people to process the content of the scam message deeply. For example, scammers use triggers that make potential victims focus on the huge prizes or benefits on offer.

There are also a number of other error-inducing processes that emerged, including:

-

- Scarcity cues.

Scams are often personalised to create the impression that the offer is unique to the recipient. They also emphasise the urgency of a response to reduce the potential victim’s motivation to process the scam content objectively

- Induction of behavioural commitment.

Scammers ask their potential victims to make small steps of compliance to draw them in, and thereby cause victims to feel committed to continue sending money

- The disproportionate relation between the size of the alleged reward and the cost of trying to obtain it.

Scam victims are led to focus on the alleged big prize or reward in comparison to the relatively small amount of money they have to send in order to obtain their windfall; a phenomenon called ‘phantom fixation’.

The high value reward (often life-changing, medically, financially, emotionally or physically) that scam victims thought they could get by responding, makes the money to be paid look rather small by comparison

- Lack of emotional control.

Compared to non-victims, scam victims report being less able to regulate and resist emotions associated with scam offers. They seem to be unduly open to persuasion, or perhaps unduly undiscriminating about who they allow to persuade them.

This creates an extra vulnerability in those who are socially isolated, because social networks often induce us to regulate our emotions when we otherwise might not.

Psychological harm to victims

Scams cause psychological as well as financial harm to victims. Victims not only suffer a financial loss, but also a loss of self-esteem because they blame themselves for having been so ‘stupid’ to fall for the scam. Some of the victims interviewed appeared to have been seriously damaged by their experience.

Advice for victims

- Drop all contact with the scammer.

- Don’t try to track them down – remember, the scammer has your real details and possibly compromising information about you. It’s not worth the risk to continue talking to them, and especially not worth confronting them.

- If you send cash, there’s no realistic way to get it back – beware the “recovery scam” where the scammer then claims to be an agency able to get the money back, for a fee.

- Contact the police.

- Share as many details about the scam as you can to warn others.

Conclusion

In conclusion, we need to always be careful and know the scam warning signs. Because we never know what will happen to us, even a friend and/or workmate could scam you if they have a chance. There is a story of a woman who lost $2300 to a cryptocurrency scam from her 12 years coworker (read more here).

Another story that we can reflect: More than £65,000 lost over fake ‘family member’ messages – BBC News

Be vigilant, Dear Readers.

Catch When Expert Meets Expert by Eugene Chung articles every bi-weekly Tuesday. Don’t forget to subscribe to stay connected. You are also encouraged to ask questions and seek advice from him.

Share this post

Related Posts

Cybersecurity: Achieving the ‘Hole-in-One’ of Digital Defence

- 07 Nov 2023

- By:Bernadetta Septarini

- Category: When Experts Meet Experts (WEME)

Discover the connection between cybersecurity and sports with Tony Smith, Regional VP at WithSecure. Let’s achieve the ‘Hole-in-One’ of Digital Defense.

Beware of Scare Software aka Scareware

- 21 Nov 2022

- By:Eugene Chung

- Category: When Experts Meet Experts (WEME)

What is Scare Software or Scareware? Learn more about this Social Engineering technique that aimed to scare the victim with ArmourZero mentor Eugene Chung.

Job Hunting Tips for IT Graduates

- 14 Nov 2022

- By:Ts. Saiful Bakhtiar Osman

- Category: When Experts Meet Experts (WEME)

The job market is tough and competitive. Learn some tips on how to do job hunting for IT graduates from ArmourZero’s mentor and expert Ts. Saiful Bakhtiar.

Tips to Successfully Sell a Credible Cybersecurity Solution

- 07 Nov 2022

- By:Eugene Chung

- Category: When Experts Meet Experts (WEME)

How do Cybersecurity sales convince prospects to trust their services and/or products? Learn more about it from ArmourZero’s mentor and expert Eugene Chung.